Financial literacy is more than just knowing how to balance a checkbook or read a profit-and-loss statement. It is the foundation of making informed business decisions that can lead to sustainable growth, profitability, and success. In this comprehensive guide, we will dive deep into key financial principles and strategies that entrepreneurs, small business owners, and startups can apply to drive business growth. We’ll explore proven techniques for budgeting, cash flow optimization, investment, and risk management, alongside practical examples and real-life tips.

Why Financial Literacy Matters for Business Success

Many entrepreneurs and small business owners focus solely on their product or service, forgetting that understanding financial health is essential for long-term growth. Business development, financial planning, and strategic investments are all key pillars of a solid financial foundation.

According to the U.S. Small Business Administration, nearly 20% of small businesses fail within the first year, and about 50% fail by the fifth year. Lack of financial literacy is often cited as a primary cause for this high failure rate. Therefore, improving your financial literacy can significantly increase your chances of long-term success and profitability.

Key Financial Concepts Every Business Owner Should Know

- Cash Flow Management

Cash flow refers to the movement of money in and out of your business. Managing cash flow effectively is vital to ensuring your business has enough liquidity to cover its expenses and reinvest in growth. According to a survey by Intuit, 61% of small businesses struggle with cash flow problems, which can stall growth and lead to closure. Real-life Tip: Create a cash flow forecast to monitor your income and expenses. Tools like QuickBooks or Xero can help you track real-time financial data. Regularly reviewing your cash flow will help you make informed decisions, such as when to invest in new resources or scale back expenses. - Budgeting for Business Growth

A well-planned budget is the cornerstone of effective business strategy. By allocating resources to the most profitable areas of your business, you can achieve growth while maintaining operational efficiency. A clear budget also ensures you can navigate market changes and business risks effectively. Example: A startup looking to invest in digital marketing should create a detailed marketing budget, factoring in ad spend, software costs, and human resources. This ensures that cash flow is not disrupted and investments can be measured against return on investment (ROI). - Profitability and ROI

Profitability refers to the ability of a business to generate more income than expenses. Maximizing profitability involves strategic decisions like cost-cutting, improving operational efficiency, and focusing on high-margin products or services. Real-life Tip: Continuously analyze your profitability margins. For example, if you run a product-based business, assess your cost of goods sold (COGS) and determine where you can negotiate better prices with suppliers or cut unnecessary operational costs. - Investment Strategies for Business Expansion

Whether you are investing in new equipment, technology, or expanding to new markets, every business decision comes with a financial component. Strategic investment in your business is essential for scaling operations and reaching new customers. Example: A small retail business might choose to invest in an e-commerce platform. The investment might initially seem high, but with the right digital marketing strategy, it could lead to a broader customer base and increased sales. - Risk Management in Small Businesses

Every business faces risks, whether they are related to market conditions, competition, or internal operations. Risk management involves identifying potential threats to your business and developing strategies to mitigate them. Real-life Tip: Diversify your revenue streams. For instance, during the COVID-19 pandemic, many brick-and-mortar businesses that had no online presence struggled. However, those that had already diversified into e-commerce were able to sustain themselves.

Building a Scalable Business Model for Growth

Scaling a business successfully requires more than just increasing sales—it demands a business model that is designed for growth without drastically increasing costs. Scaling up requires the right balance of operational efficiency, market research, sales management, and customer engagement.

- Operational Efficiency and Business Strategy

To scale your business effectively, it’s crucial to focus on streamlining operations. This could involve automating repetitive tasks, outsourcing non-core activities, or adopting new technologies like customer relationship management (CRM) systems. Example: A small software company might use cloud-based project management tools like Asana or Trello to improve team collaboration and increase operational efficiency without needing additional staff. - Market Research and Business Development

Expanding into new markets requires thorough market research. Understanding customer behavior, competitor strategies, and market trends helps tailor your business approach and offerings. Real-life Tip: Use tools like Google Trends, SEMrush, or Statista to conduct market research before entering a new market. This will help you identify demand, competition, and potential barriers to entry. - Personal Branding for Thought Leadership

Building a personal brand is critical for positioning yourself as a thought leader in your industry. Entrepreneurs who invest in their personal brand can create trust and loyalty, attracting both clients and investors. Example: Leverage platforms like LinkedIn or Medium to share insights and experiences from your entrepreneurial journey. By positioning yourself as an expert, you can increase your business’s visibility and build a strong network.

Maximizing Sales and Customer Engagement

Customer engagement is the heartbeat of any successful business. It’s not enough to simply acquire customers; you need to engage them continually and provide a seamless customer experience.

- Sales Management for Business Growth

Effective sales management involves developing a comprehensive sales strategy, setting realistic sales goals, and ensuring that your sales team has the tools they need to succeed. This includes using sales analytics to track performance and adjust strategies. Real-life Tip: Implement a CRM system like Salesforce or HubSpot to track customer interactions, analyze sales data, and identify areas for improvement. This ensures that your sales efforts are targeted and aligned with your overall business growth strategy. - Proven Methods for Engaging Your Audience Online

Building an online presence is non-negotiable in today’s digital world. Whether through social media, blogs, or email marketing, creating engaging content helps keep your audience invested in your brand. Example: Regularly posting on social media platforms like Instagram, LinkedIn, or Facebook, while using engagement-driven content (polls, quizzes, behind-the-scenes posts), helps build relationships with your audience and improves brand loyalty.

Financial Planning and Debt Financing

Financial planning for business success isn’t just about budgeting—it’s also about leveraging debt financing when needed and planning for long-term sustainability.

- Debt Financing and Business Expansion

Many small businesses require external financing to scale operations. Debt financing, whether through loans or lines of credit, can be a crucial tool for growth when managed effectively. Real-life Tip: Consider debt financing options like SBA loans or business lines of credit. However, be sure to calculate your debt service coverage ratio (DSCR) to ensure that you can meet your repayment obligations without hurting your cash flow. - Return on Investment (ROI) and Business Growth

Tracking your ROI is critical to understanding which investments are truly benefiting your business. From marketing campaigns to product development, evaluating the ROI on every decision ensures resources are allocated to areas that will generate the highest returns. Example: A digital marketing agency might invest in SEO strategies to boost organic traffic. By tracking key metrics like website traffic, lead generation, and conversion rates, they can assess whether the investment is driving sufficient ROI.

Risk Management and Financial Sustainability

Finally, let’s talk about financial sustainability. Businesses that focus on long-term risk management and sustainability are better positioned to navigate economic uncertainties and market disruptions.

- Comprehensive Risk Management for Small Business Owners

Managing risks is crucial to safeguarding your business against potential losses. Develop a risk management plan that includes insurance, diversification, and regular financial audits to identify and mitigate potential risks. Real-life Tip: Conduct regular SWOT (Strengths, Weaknesses, Opportunities, and Threats) analyses. This will give you a clear view of internal and external risks and help you take proactive measures to address them. - Effective Financial Management Strategies for Small Businesses

Having a sound financial management strategy is critical for long-term success. This includes regular financial reviews, managing liabilities, and ensuring you have a solid emergency fund to navigate unexpected disruptions. Example: A small business should aim to have at least three to six months of operating expenses saved in an emergency fund. This cushion will allow you to survive periods of low revenue without having to cut critical operations.

Conclusion: Achieving Sustainable Business Growth

Financial literacy is more than just a skill—it’s a critical component of business success. By understanding key financial principles such as cash flow management, profitability, investment strategies, and risk management, you can create a scalable, sustainable business model. This not only improves your chances of long-term success but also helps you achieve the financial stability needed to grow and expand your business effectively.

To sum it up, whether you’re a seasoned entrepreneur or just starting your small business journey, focusing on financial literacy will empower you to make smarter decisions, manage risks, and drive profitability. Use the tools, tips, and strategies shared in this guide to transform your business into a thriving, scalable venture.

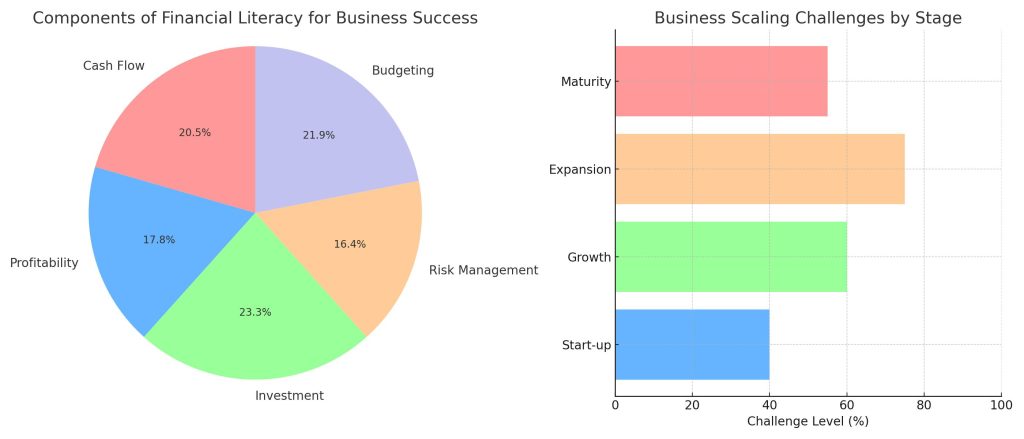

Here are two charts related to the topic of financial literacy and business growth:

- Components of Financial Literacy for Business Success: This pie chart shows the importance of various financial literacy elements—cash flow, profitability, investment, risk management, and budgeting—toward business success.

- Business Scaling Challenges by Stage: The horizontal bar chart highlights the level of challenges businesses face during different stages: start-up, growth, expansion, and maturity. Each stage presents its unique set of difficulties as businesses work toward scalability and sustainability.

These visual aids can help provide clarity when strategizing financial planning and business development.

Practical Exercises to Enhance Financial Literacy

Understanding financial literacy is crucial for driving business growth and profitability. To solidify your knowledge and apply the concepts discussed, engaging in practical exercises can be highly beneficial. Below are several exercises designed to help you grasp key financial principles, complete with tables and charts to facilitate your learning and application.

1. Cash Flow Projection Exercise

Objective: Learn to forecast your business’s cash inflows and outflows to manage liquidity effectively.

Exercise Steps:

- List All Cash Inflows:

- Sales revenue

- Loans or investments

- Asset sales

- Other income sources

- List All Cash Outflows:

- Operating expenses (rent, utilities, salaries)

- Cost of goods sold (COGS)

- Loan repayments

- Capital expenditures

- Taxes and other obligations

- Create a Monthly Cash Flow Projection:

| Month | January | February | March | Total |

|---|---|---|---|---|

| Cash Inflows | ||||

| Sales Revenue | $10,000 | $12,000 | $11,000 | $33,000 |

| Loans/Investments | $5,000 | $0 | $0 | $5,000 |

| Total Inflows | $15,000 | $12,000 | $11,000 | $38,000 |

| Cash Outflows | ||||

| Operating Expenses | $6,000 | $6,500 | $6,200 | $18,700 |

| COGS | $3,000 | $3,200 | $3,100 | $9,300 |

| Loan Repayments | $1,000 | $1,000 | $1,000 | $3,000 |

| Capital Expenditures | $2,000 | $0 | $1,500 | $3,500 |

| Total Outflows | $12,000 | $10,700 | $11,800 | $34,500 |

| Net Cash Flow | $3,000 | $1,300 | -$800 | $3,500 |

| Opening Balance | $2,000 | $5,000 | $6,300 | |

| Closing Balance | $5,000 | $6,300 | $5,500 |

Analysis:

- Positive Net Cash Flow: Indicates sufficient liquidity to cover expenses and invest in growth.

- Negative Net Cash Flow: Highlights the need to adjust expenses or increase revenue.

2. Budgeting Exercise

Objective: Develop a comprehensive budget to allocate resources effectively and monitor financial performance.

Exercise Steps:

- Identify Budget Categories:

- Revenue

- Fixed Expenses

- Variable Expenses

- Savings/Investments

- Allocate Monthly Budget:

| Category | Planned Amount | Actual Amount | Variance |

|---|---|---|---|

| Revenue | $30,000 | $32,000 | +$2,000 |

| Fixed Expenses | |||

| Rent | $2,000 | $2,000 | $0 |

| Utilities | $500 | $450 | +$50 |

| Salaries | $10,000 | $10,000 | $0 |

| Total Fixed | $12,500 | $12,450 | +$50 |

| Variable Expenses | |||

| Marketing | $3,000 | $3,200 | -$200 |

| Inventory | $5,000 | $4,800 | +$200 |

| Miscellaneous | $1,000 | $1,200 | -$200 |

| Total Variable | $9,000 | $9,200 | -$200 |

| Savings/Investments | $3,500 | $1,350 | -$2,150 |

| Total Expenses | $24,000 | $22,600 | +$1,400 |

| Net Budget | $6,000 | $9,400 | +$3,400 |

Analysis:

- Variance Analysis: Helps identify areas where you are overspending or saving more than planned.

- Adjust Future Budgets: Use variances to adjust future budget allocations for better financial control.

3. Return on Investment (ROI) Calculation Exercise

Objective: Evaluate the profitability of investments to make informed financial decisions.

Exercise Steps:

- Identify Investments:

- Digital Marketing Campaign

- New Equipment Purchase

- Employee Training Program

- Calculate ROI for Each Investment:

| Investment | Cost ($) | Gain ($) | ROI (%) |

|---|---|---|---|

| Digital Marketing | $5,000 | $15,000 | [(15,000 – 5,000) / 5,000] * 100 = 200% |

| New Equipment | $10,000 | $14,000 | [(14,000 – 10,000) / 10,000] * 100 = 40% |

| Employee Training | $2,000 | $3,000 | [(3,000 – 2,000) / 2,000] * 100 = 50% |

Analysis:

- High ROI Investments: Prioritize investments with higher ROI for maximum profitability.

- Balanced Portfolio: Consider a mix of high and moderate ROI investments to diversify risk.

4. SWOT Analysis Exercise

Objective: Identify strengths, weaknesses, opportunities, and threats to strategically position your business.

Exercise Steps:

- Fill in Each Quadrant:

| Strengths | Weaknesses |

|---|---|

| – Strong brand reputation | – Limited financial resources |

| – Skilled and dedicated team | – Dependence on a single supplier |

| – Innovative product offerings | – Limited online presence |

| Opportunities | Threats |

|---|---|

| – Expanding into new markets | – Increasing competition |

| – Technological advancements | – Economic downturns |

| – Growing demand for sustainable products | – Regulatory changes |

Analysis:

- Leverage Strengths: Utilize your strengths to take advantage of opportunities.

- Address Weaknesses: Develop strategies to mitigate or eliminate weaknesses.

- Mitigate Threats: Prepare contingency plans to handle potential threats.

5. Financial Planning Exercise

Objective: Create a basic financial statement to understand your business’s financial health.

Exercise Steps:

- Prepare an Income Statement:

| Income Statement | Amount ($) |

|---|---|

| Revenue | |

| Sales Revenue | $50,000 |

| Other Income | $5,000 |

| Total Revenue | $55,000 |

| Expenses | |

| Cost of Goods Sold (COGS) | $20,000 |

| Operating Expenses | $15,000 |

| Marketing Expenses | $5,000 |

| Salaries and Wages | $10,000 |

| Total Expenses | $50,000 |

| Net Profit | $5,000 |

- Prepare a Balance Sheet:

| Balance Sheet | Amount ($) |

|---|---|

| Assets | |

| Current Assets | $30,000 |

| Fixed Assets | $20,000 |

| Total Assets | $50,000 |

| Liabilities | |

| Short-term Liabilities | $10,000 |

| Long-term Liabilities | $15,000 |

| Total Liabilities | $25,000 |

| Equity | $25,000 |

| Total Liabilities & Equity | $50,000 |

Analysis:

- Income Statement: Shows profitability over a specific period.

- Balance Sheet: Provides a snapshot of your business’s financial position at a given time.

6. Break-Even Analysis Exercise

Objective: Determine the point at which your business covers all its costs and begins to generate profit.

Exercise Steps:

- Identify Fixed and Variable Costs:

| Cost Type | Amount ($) |

|---|---|

| Fixed Costs | $10,000 |

| Variable Cost per Unit | $20 |

- Determine Selling Price per Unit:

| Selling Price per Unit | $50 |

- Calculate Break-Even Point:

[ \text{Break-Even Point (Units)} = \frac{\text{Fixed Costs}}{\text{Selling Price per Unit} – \text{Variable Cost per Unit}} ]

[ \text{Break-Even Point} = \frac{10,000}{50 – 20} = \frac{10,000}{30} = 334 \text{ units} ]

Analysis:

- Break-Even Point: You need to sell 334 units to cover all costs.

- Profitability Goal: Any sales beyond 334 units contribute to profit.

7. Debt Service Coverage Ratio (DSCR) Calculation Exercise

Objective: Assess your business’s ability to service its debt obligations.

Exercise Steps:

- Identify Net Operating Income (NOI): $15,000

- Identify Total Debt Service: $5,000

- Calculate DSCR:

[ \text{DSCR} = \frac{\text{Net Operating Income}}{\text{Total Debt Service}} ]

[ \text{DSCR} = \frac{15,000}{5,000} = 3.0 ]

Interpretation:

- DSCR > 1: Indicates sufficient income to cover debt obligations.

- DSCR < 1: Suggests potential difficulty in meeting debt obligations.

8. Personal Branding Exercise

Objective: Develop a personal branding strategy to establish thought leadership and enhance your business’s reputation.

Exercise Steps:

- Define Your Brand Identity:

| Element | Description |

|---|---|

| Mission Statement | “Empowering small businesses through innovative financial strategies.” |

| Core Values | Integrity, Innovation, Customer-Centric |

| Unique Selling Proposition (USP) | “Combining deep financial expertise with personalized business growth solutions.” |

- Create a Content Plan:

| Content Type | Topic | Frequency |

|---|---|---|

| Blog Posts | Financial Management Tips for SMEs | Weekly |

| Social Media | Quick Financial Tips and Insights | Daily |

| Webinars | Strategies for Sustainable Business Growth | Monthly |

| Newsletters | Monthly Financial Updates and Advice | Monthly |

- Engage with Your Audience:

| Platform | Engagement Strategy |

|---|---|

| Share industry insights, participate in discussions | |

| Post regular tips, engage with followers through polls | |

| YouTube | Publish educational videos on financial literacy |

| Share behind-the-scenes content, infographics |

Analysis:

- Consistent Branding: Ensures your personal brand is recognizable and trustworthy.

- Engagement: Regular interaction with your audience builds loyalty and authority.

9. Scenario Planning Exercise

Objective: Prepare for different business scenarios to enhance your strategic planning and risk management.

Exercise Steps:

- Identify Possible Scenarios:

| Scenario | Description |

|---|---|

| Best-Case | Rapid market expansion with high sales growth |

| Worst-Case | Economic recession leading to decreased sales |

| Most Likely | Steady growth with occasional market fluctuations |

- Develop Action Plans for Each Scenario:

| Scenario | Action Plan |

|---|---|

| Best-Case | Scale operations quickly, invest in new technologies, hire additional staff |

| Worst-Case | Cut non-essential expenses, seek alternative revenue streams, renegotiate loans |

| Most Likely | Maintain steady operations, monitor market trends, adjust strategies as needed |

Analysis:

- Proactive Planning: Being prepared for different scenarios ensures your business can navigate uncertainties effectively.

- Flexibility: Allows your business to adapt strategies based on real-time developments.

10. Investment Decision Matrix Exercise

Objective: Evaluate and prioritize potential investments based on multiple criteria to make informed decisions.

Exercise Steps:

- List Potential Investments:

| Investment | Criteria | Weight | Score (1-5) | Weighted Score |

|---|---|---|---|---|

| Digital Marketing | ROI | 0.4 | 5 | 2.0 |

| New Equipment | Operational Efficiency | 0.3 | 4 | 1.2 |

| Employee Training | Employee Productivity | 0.3 | 3 | 0.9 |

| Total | 1.0 | 4.1 |

- Calculate Weighted Scores:

[ \text{Weighted Score} = \text{Weight} \times \text{Score} ]

- Prioritize Investments:

- Highest Weighted Score: Prioritize investments with the highest scores as they align best with your business goals.

Analysis:

- Objective Evaluation: Ensures investments are aligned with strategic priorities and offer the best returns.

- Balanced Decision-Making: Considers multiple factors, not just financial returns.

Conclusion

Engaging in these practical exercises will deepen your understanding of financial literacy and equip you with the tools to manage your business’s finances effectively. By regularly practicing cash flow projections, budgeting, ROI calculations, and other financial assessments, you can make informed decisions that drive business growth and profitability. Additionally, exercises like SWOT analysis and scenario planning enhance your strategic thinking, ensuring your business remains resilient and adaptable in a dynamic market environment.

Take Action:

- Schedule regular financial review sessions using these exercises.

- Utilize software tools like Excel, Google Sheets, QuickBooks, or Xero to streamline these processes.

- Continuously educate yourself on financial management best practices to stay ahead in your entrepreneurial journey.

By incorporating these exercises into your routine, you’ll build a solid foundation in financial literacy, paving the way for sustained business success and growth.

Additional Resources

To further enhance your financial literacy and business acumen, consider exploring the following resources:

- Books:

- “Financial Intelligence for Entrepreneurs” by Karen Berman and Joe Knight

- “Profit First” by Mike Michalowicz

- Online Courses:

- Coursera: Financial Management for Small Businesses

- edX: Introduction to Corporate Finance

- Tools:

- QuickBooks: Comprehensive accounting software for small businesses.

- Trello or Asana: Project management tools to improve operational efficiency.

- Google Analytics: For business analytics and market research.

By leveraging these resources alongside the exercises provided, you’ll be well-equipped to navigate the financial complexities of running a successful business.

Acknowledgments

Thank you for taking the time to enhance your financial literacy. By investing in your financial knowledge, you’re investing in the future success of your business. Stay proactive, stay informed, and continue striving for excellence in all your business endeavors.

Call to Action

Ready to take your business to the next level? Start by completing these financial literacy exercises today and watch your business thrive. For personalized advice and more in-depth strategies, consider consulting with a financial advisor or business consultant.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial or business advice. Always consult with a professional advisor before making significant business decisions.

Leave a Reply